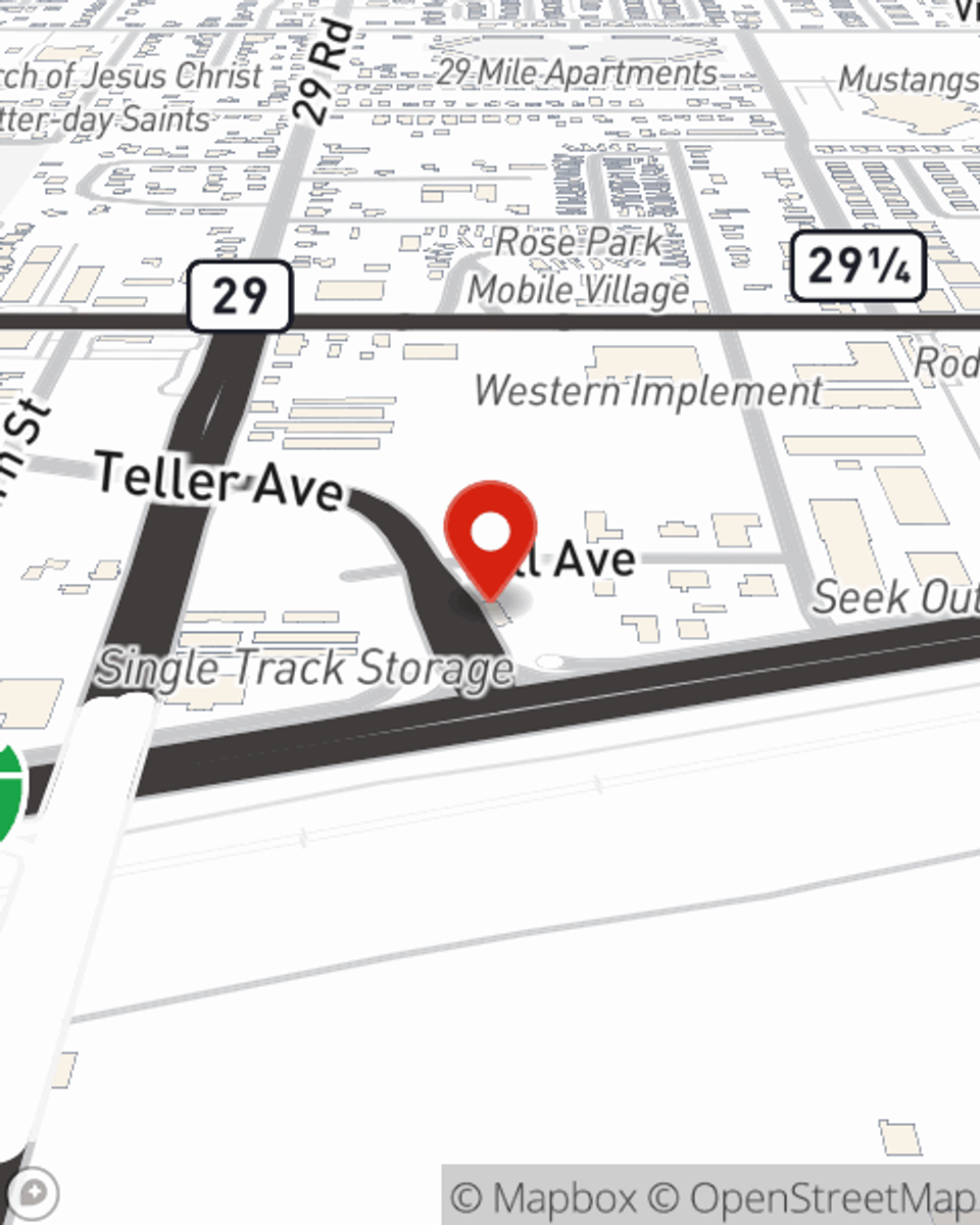

Renters Insurance in and around Grand Junction

Welcome, home & apartment renters of Grand Junction!

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Grand Junction

- Grand Junction, CO

- Clifton

- Palisade, CO

- Fruita, CO

- 81504

- 81501

- 81503

- 81505

- Mesa County, CO

- 81507

- 81526

- Clifton, CO

- Palisade

- Fruita

- Western Slope

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented condo or apartment, renters insurance can be one of those most reasonable things you can do to protect your belongings, including your guitar, furniture, bicycle, children's toys, and more.

Welcome, home & apartment renters of Grand Junction!

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Sean Brumelle can help you develop a policy for when the unexpected, like a fire or a water leak, affects your personal belongings.

There's no better time than the present! Get in touch with Sean Brumelle's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Sean at (970) 523-9700 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Sean Brumelle

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.